Product Updates October 31, 2024

Alkymi launches fund tracking for private markets for better transparency and reporting

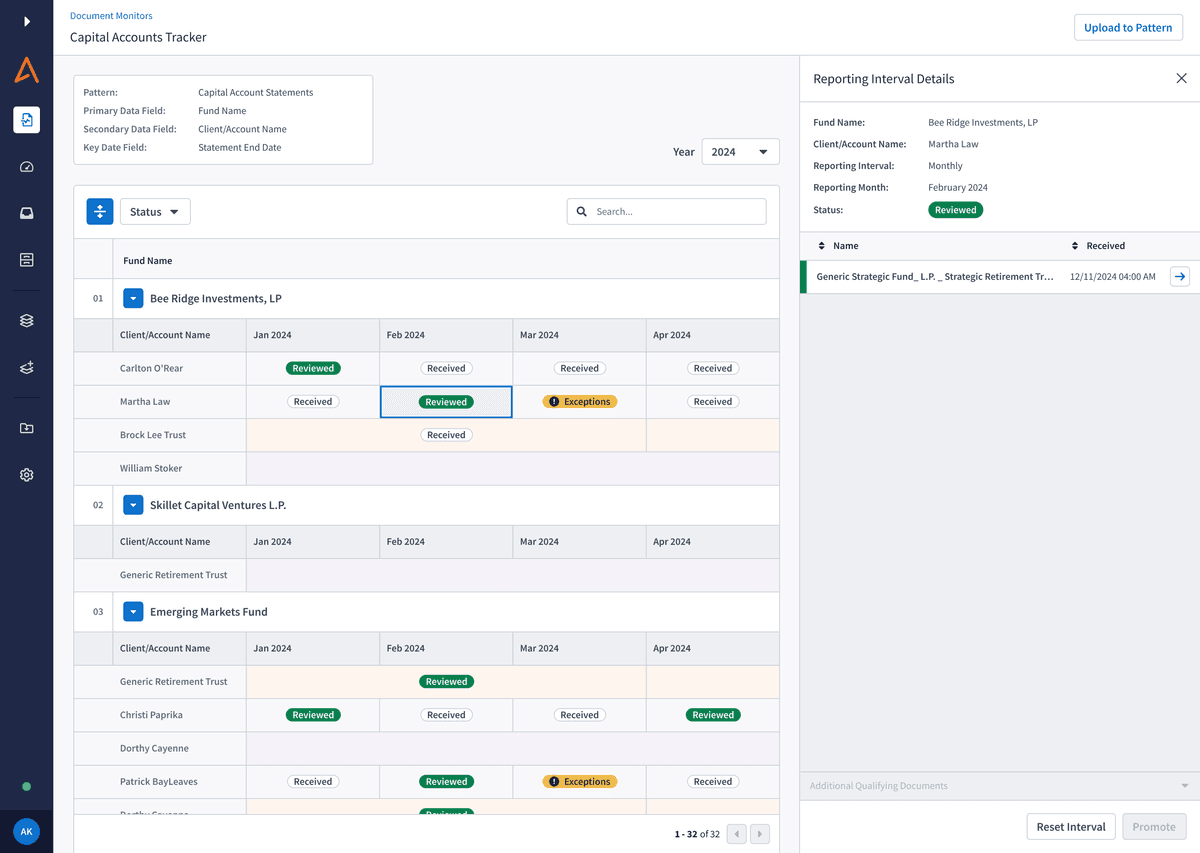

Today we’re announcing an exciting enhancement to Alkymi’s platform: automated fund tracking. Ensure you never miss critical investment data and get a comprehensive view of fund performance over time with automatic tracking for your incoming fund and portfolio data, designed for your firm’s reporting requirements.

Our new fund tracking feature gives you full insight into all your incoming and expected investment data in one place, alongside your data transformation and review workflows, increasing visibility and organization for your portfolio. Track submissions from investment managers, clients, and funds you’re invested in automatically, so you can easily review fund performance and quickly identify missing or delayed documents.

Private markets investing involves hundreds or thousands of incoming documents each year across funds, clients, and investments, each of which must be received, processed, and entered into your firm’s accounting and portfolio management systems. With automated tracking integrated into your data workflows, you can oversee your data ingestion, transformation, and delivery in one central platform and make sure all your data is accounted for—better enabling you to compare fund performance over time, assess and manage risk, and ensure accurate reporting.

The Fund Tracker is fully customizable to client specifications, ensuring you can monitor the fund data you need. View all documents by fund in one place for each of your use cases to quickly alert your team to missing submissions, without the need to search through files. Click through directly to each document to review your processed data and send it to your downstream systems.

Fund tracking is a key addition to Alkymi’s suite of AI-powered Patterns and tools for private markets use cases, which already includes:

- Automated workflows for use cases across private markets, such as capital calls and distributions, capital account statements, and schedules of investments, as well as financial statements, loan agent notices, CIMs, and more.

- Portal document retrieval to manage data ingestion from investor portals on your firm’s behalf and automatically send data to Alkymi’s platform for processing.

- Auto-Tagging to further organize your incoming documents by Fund Name, document type, or other field values.

- LLM-powered tools and generative AI to interact with your datasets and extract and process data from lengthy, complex documents, through your choice of models.

- Built-in transformations, enrichments, and data mapping to ensure incoming data aligns with your firm’s data dictionaries and systems.

- Data validation to check for missing or incorrect data fields so you can be sure your data adds up, both logically and mathematically.

- Integrations with your downstream systems, including pre-built and custom integrations with your portfolio management tools, such as Snowflake and Investtran, so you can connect your processed and transformed data directly to your firm.

To learn more about our new Fund Tracker, reach out to your Alkymi team or schedule a demo.

More from the blog

Alkymi is a Finalist for the FTF News Technology Innovation Awards 2025

by Harald ColletAlkymi has been named a finalist in six categories for the Financial Technologies Forum 2025 Innovation Awards

Q1 2025 in Review: Data Automation Accelerates in Private Markets

by Harald ColletAlkymi is accelerating into 2025 with a strong Q1. Alkymi is reshaping data automation for financial services.

New Client: One of the World's Largest Private Banks

by Harald ColletAlkymi welcomes a new client to our growing community! We're committed to transforming workflows and empowering businesses with intelligent automation.